Concentrate on Getting Personal Finances in Order

- Home

- Basic Productivity Skills

- Getting Personal Finances in Order

Leaders who want to avoid burnout understand the benefits of getting personal finances in order.

Having your personal finances under control brings freedom. It allows you to concentrate on your leadership responsibilities without worrying about your money.

Money challenges usually aren't the up-front cause of burnout my executive coaching clients mention, but any stress around finances adds a "running in the background" level of stress that plays on them in major ways.

What's healthy? Bills are paid on time. There is reserve set aside for the future and the unexpected. There are adequate resources to play, refresh and renew. You can enjoy generosity and the thrill of sharing.

Freedom reduces worry. You can give your attention to priorities. Nothing is happening in the background of your mind to divert your attention from daily tasks.

Having your finances in order

allows you to operate at your very best.

Money concerns can be debilitating, and the eight-figure leader can experience the same problems as the five-figure one. Money is a big topic. Worries about it can consume huge amounts of thinking time, so take control of your money.

Don't let it take control of you.

"No matter how much or how little material wealth a person has (and everyone has some), he must be careful not to “treasure” it. He should be grateful for it, he is free to enjoy it, but he must not ascribe to it worth beyond its due."

Randy Alcorn, Money, Possessions and Eternity

Five Days of Coaching as You Concentrate on Getting Personal Finances in Order

DAY ONE

Today is the day to begin working on your relationship with money, and yes, you do have a relationship with it. Everyone has a certain mindset toward their finances. It's either in good shape or it's not. Find out what you believe about money. Examine your commitment to it. Notice the structures you've created around it. Be honest about the actions you've taken with it. Define the outcomes you want for your money.

The Coach asks:

- Take some time to record what you actually believe about money? You having money? How money should be used? How much is enough? How much is more than is needed? What are your beliefs, your mindset regarding money. Be as thorough as you can in reflecting on this.

- What structures have you put in place around your money? How are they serving you? How would you like them to serve you?

- How have you generally used money in the past? Big spender? Tight-wad? Just about right? Think about some of the big mistakes you've made with money? Think about some of the very wise moves you've made with money? What are you learning or reaffirming about your practices and habits?

- What outcomes do you have for the money that you gain? What are your targets or goals for the use of your money? Are they realistic? Too small? Under-informed? Right on?

DAY TWO

This is a planning day. Based on yesterday's work, what did you determine needs to happen with your money? Are you in great shape? Do you need to make an attitude adjustment? Do you need to find out how to handle some aspect of your money better? Draft a plan to get your financial house in order.

The Coach asks:

- Based on your reflections yesterday, what would you like to see moving forward? What will need to be adjusted to make this happen? How does your attitude play into this and what might need to be adjusted there?

- Precisely what aspect of handling your finances needs attention?

- Create a plan to be intentional about getting finances in order. It doesn't have to be perfect. You can always make adjustments. But it does need to be clear, with doable action items you can execute on.

- Discuss your plan with anyone else who might be involved like a spouse or partner. What is there input around changes that have to be made to get the financial house in order.

DAY THREE

If you are having challenges with planning for and managing money, there are many quality resources that outline simple plans for improving your financial health. Take time today to scan through a number of books or websites and see if one would be of assistance. Determine to become a continuous financial learner. Healthy finances depend more on what you do with your money than how much of it you make.

The Coach asks:

- Financial literacy is crucial. Perhaps you know a lot about money. Maybe you know little. What is it you would like to learn about handling your money and getting your finances to where you wish them to be?

- Start looking for the information you need. Books, websites, podcasts, videos, there are so many resources. Find those few that are in line with your personal values and goals. Get them in front of you and start learning.

- Take notes of those strategies you would like to implement. Determine to pursue best practices in the wise management of your funds.

DAY FOUR

Take the first steps towards your financial plan today. If your finances are in good shape, begin to work on getting them in great shape. If you are in trouble, take the first steps to change course. Determine to never again be a slave to money by not having a plan. If it's still too much for you, find an expert who can assist you. Keep momentum.

The Coach asks:

- Given what you've learned so far, how helpful would it be to get the assistance of an expert in this area? Is this a need or not?

- What is your plan? Do you know how to carry it out? Are other key people on board with what needs to happen? Start.

- Sometimes this is not an overnight fix. Your finances may require some time to get back to where you want them to be. That's okay. Just keep at it. Don't give up. Determine that, insofar as you have control of it, you will not be a slave to money ever again.

DAY FIVE

You have placed yourself on a path to financial freedom. You are not going to be enslaved to debt. Notice the energy that gives you to devote to other priorities. As money ceases to be a worry, your energy, effectiveness and productivity can go up. Make a commitment to yourself and your family to operate differently from here on in.

The Coach asks:

- As money ceases to be the worry it was, notice how your energy level rises? Notice how you can more fully "give all of your brain" to the leadership responsibilities that are yours. How's that feel?

- If needed, how are you drawing the rest of your family into healthy handling of money? What needs to happen? What more can you do?

- What does "financial freedom" mean to you? Will your current plan get you there?

- Maintain momentum. You are a leader. Lead in this very personal area of your life as well. Enjoy the freedom getting personal finances in order will bring.

The Righteous Will Thrive Like a Green Leaf

As a Christian Executive Leadership Coach I encourage Christian leaders to reflect on God's Word to add to their wisdom. When it comes to getting personal finances in order, there are a tremendous number of references and much instruction.

The scriptures contain more practical instruction on getting personal finances in order than on many other topics. Search it out. You will find help.

- Pr 11:28 Those who trust in their riches will fall, but the righteous will thrive like a green leaf.

- Lk 14:28 Suppose one of you wants to build a tower. Won't you first sit down and estimate the cost to see if you have enough money to complete it.

- Php 4:19 And my God will meet all your needs according to the riches of his glory in Christ Jesus.

- Na 1:7 The Lord is good, a refuge in times of trouble. He cares for those who trust in him.

- Heb 13:5,6 Keep your lives free from the love of money and be content with what you have, because God has said, "Never will I leave you; never will I forsake you." So we say with confidence, "The Lord is my helper; I will not be afraid .."

- The rich rule over the poor, and the borrower is slave to the lender.

If you are a leader, executive, or senior level professional looking to work with a Christian Executive Coach, I invite you to connect with me here.

If appropriate, we can meet by phone or Zoom to discuss your situation.

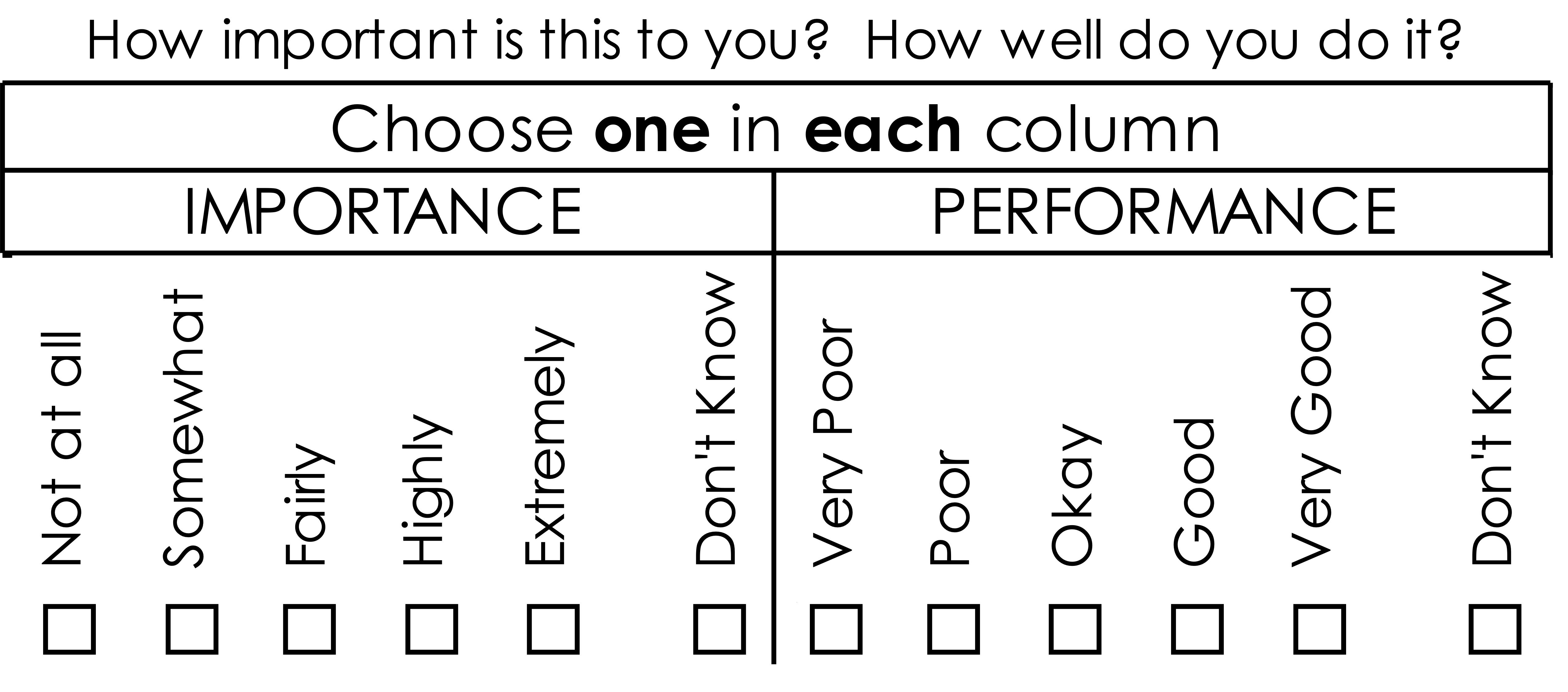

Record Your Progress

This is your opportunity to track your progress. Start by asking yourself how important this practice is to you? Record the importance as - not at all, somewhat, fairly, highly or extremely.

Now next to it ask yourself how well you carry out this practice. Record your performance as - very poor, poor, okay, good or very good.

The things we track, we pay attention to. Across time, come back and record your new results. You will find that as you are intentional about making improvements, you will bump your "score" up higher.

This is significant. Don't miss the opportunity to acknowledge your success, and use it as a springboard for making even further gain.

Return to further everyday habits that highly productive leaders use.

Notes

Worrying about your personal finances can suck the energy out of you. Sure, you compartmentalize and focus on your work, but that nagging worry is always there in the back of your mind.

Being intentional about getting personal finances in order will lead to clearer thinking unimpeded by personal worries (at least around money.) This is a really, really important area for a leader to take care of.

Contact me here Privacy Policy

© G.E.Wood and Associates. All Rights Reserved in all media.

G.E. Wood and Associates is an international coaching firm registered in Ontario, Canada

142 Pratt Crescent, Gravenhurst, Ontario, Canada, P1P 1P5